Tag archives for PDE

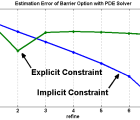

Besides European and American Options, another challenge in option pricing is the valuation of Barrier Options. We will see that simply applying the algorithms from the previous posts does not converge well. Especially, pricing a long-term up-and-out barrier option is hard, due to the discontinuity of the payoff.

An American option is an option which the owner can exercise at any time during its lifetime. That means the option’s value cannot drop below the exercise value, i.e. the option value of an American put option satisfies . (1) We use the above condition in the PDE solver (How Can I Price an Option with a PDE Method in Matlab?) to price an American […]

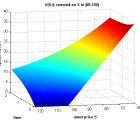

In this article, we build a very simple PDE solver for the Black-Scholes Equation. Using the Finite Volume Discretization Method, we derive the equations required for an efficient implementation in Matlab. The implicit Euler time-stepping of the solver guarantees a stable behavior and convergence. All posts in this series: Basics of a PDE solver in Matlab Pricing American options with […]